Asset Management Strategies

Agency-wide, corporate, and property-specific Asset Management strategies in conjunction with Housing-SolutionsSM

Mobley & Associates operates from the basic premise that long-range Asset Management (strategic) plans and activities must emerge from a clear understanding of mission-and-market. To wit, portfolio strategies must be a conscious instrument borne of clarity of the corporate mission (whether private- or public-sector) and in sober relation to the market dynamics within which real estate (conventional or affordable) operates in the subject community.

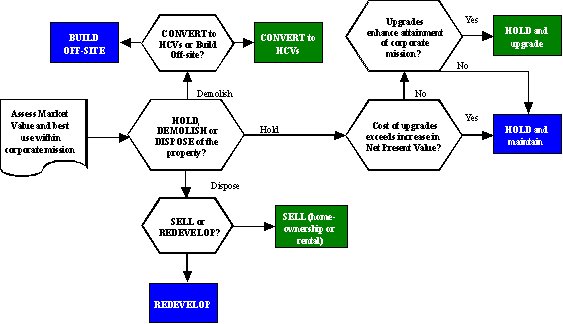

These are the key questions that are asked in an asset management approach:

- How valuable is this property? This is asked both non-economic and economic terms, capturing mission and monetary considerations.

- Should we hold, demolish or dispose of the property? The answer depends on the determination of value, in the context of the agency ’s objectives and how the property functions for its target market in its specific location.

- If we hold, should we maintain it as it is, or upgrade? The answer comes by understanding how the property compares to its competition, and to the mission the organization has set for it.

- If we demolish, should be build something somewhere else, and/or convert the subsidy to Housing Choice Vouchers? The answer to this question can be a single action, or a combination of possibilities.

- If we dispose, is it a simple sale, or do we get involved in redevelopment activities? Both the Demolish and the Dispose strategies entail understanding of how to "leverage " the value of the asset in the broader market.

This analytical process is depicted on the following flow-chart:

Representative Assignments

In 2001, Mobley & Associates (in conjunction with Housing-SolutionsSM , a consortium of a half-dozen like-minded small businesses and individuals in Colorado, Michigan, Massachusetts and Georgia), was selected by the Jackson (Tennessee) Housing Authority to develop a long-range Asset Management Plan addressing the future of its thousand-unit public housing portfolio. The Plan was developed and amplified during 2001-2002 over a fifteen-month period, and presented to the Board of Commissioners at its annual retreat. This led to the creation of a Business Plan (see below) now being implemented. Deliverables also included a Capital Needs Assessment for each of its eleven (11) complexes as well as a professional Market Study. Letter of recommendation.

In 2001, Mobley & Associates (in conjunction with selected Housing-SolutionsSM members) under contract to Atlanta-based Boulevard Group, Inc, developed a long-range Asset Management Plan with strategic recommendations for the sixteen (16) properties comprising its five-thousand-unit inventory, in coordination with a professional Market Study, for the Housing Authority of the Birmingham District (Alabama). Letter of recommendation.

In 2004, Mobley & Associates (in conjunction with Housing-SolutionsSM) was selected by the Kingsport (Tennessee) Housing and Redevelopment Authority to develop a long-range Asset Management Plan to include a Capital Needs Assessment for all or most of its 600-unit portfolio as well as coordination with a Professional Market Study. Field work for this engagement will begin in early 2005.

In 2000, Housing-SolutionsSM (including Mobley & Associates) was engaged to develop a HOPE VI application also including a broader Development Plan for the Kansas City (Kansas) Housing Authority. Residents and community members helped inaugurate the Development Plan by attending a day-long Planning Summit held at a local community college on St. Patrick’s Day, 17 March 2000. Residents, government officials (including the Chief Executive Officer of the Unified Government of Kansas City, Kansas and Wyandotte County—one of the nation’s few metropolitan governments) and other members of the community, numbering 70 in all, came together and put in motion a number of scenarios which guided the eventual formulation of the broader Development Plan.

In the late 1990s, Mobley & Associates (in conjunction with Capital Needs Unlimited, a Housing-SolutionsSM member firm headed by Thomas E. Nutt-Powell), provided strategic planning services for the Boston Housing Authority (BHA). BHA was interested in understanding the development options available for its various property types comprising its 15,000+ unit porfolio. This interest was spurred in part by a likely reduction in Federal operating subsidies, making it important that BHA be able to survive financially in order to continue in its role as the City’s primary entity dedicated to providing affordable housing for a broad range of low-income households. In addition to assessing the full set of properties, Capital Needs Unlimited also completed three market-based studies of existing properties. Each property was chosen as a prototype of the range of properties in BHA’s portfolio, including one in a strong market location, one in a mixed market location and one the location of which makes it likely to have lower-income households only. Mobley & Associates played a supporting role in this engagement, and typically collaborates with Nutt-Powell on many assignments.